Direct Article Link: https://www.wsj.com/articles/simon-meet-luma-banks-battle-for-share-in-structured-notes-1533047353

By Liz Hoffman

Goldman Sachs Group Inc. has Simon, an online platform that sells complex investment products to mom-and-pop investors. Bank of America Corp. and Morgan Stanley are now throwing their weight behind Luma.

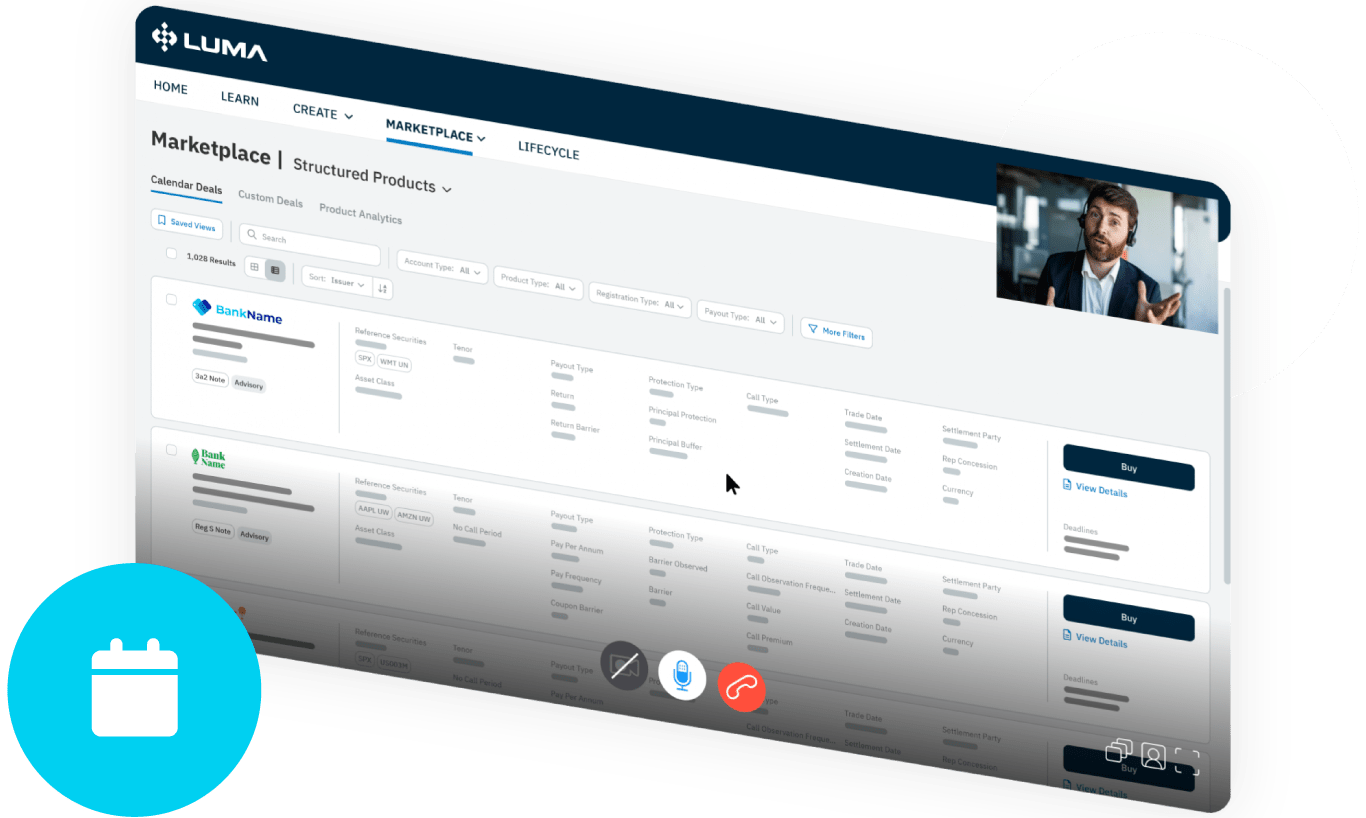

The two firms plan to announce Tuesday that they are backing a new company, Luma Financial Technologies, to connect retail brokers seeking market-linked CDs, structured notes and other products to the banks that issue them.

Bank of America and Morgan Stanley will invest in Luma and will sell their own products to its clients. Luma’s software and its chief executive, Tim Bonacci, come from Navian Capital, a wholesaler of structured products since 2011.

Mr. Bonacci declined to comment on the financial terms, as did a spokesman for Morgan Stanley. A representative for Bank of America couldn’t be immediately reached for comment.

Structured notes are custom-built by banks out of options and other derivatives. Investors pay an upfront sum — helping banks to fund their operations — and receive a future payout that is based on the performance of another asset, such as the S&P 500 index or oil prices.

The new venture will compete directly with Goldman’s platform, which launched in 2015 and sells notes through broker networks such as Raymond James Financial Inc. and LPL Financial Holdings Inc. The goal of Luma, Simon and a handful of startups is to replace expensive human sales forces and lay cheaper, digital pipes to the retail investors who buy structured notes.

Mr. Bonacci compared these digital middlemen to clearing firms and stock exchanges, with the field winnowing over time.

“I don’t think there will be 10. I don’t think there will be one,” Mr. Bonacci said in an interview. “We’re one of those leaders today and I think the opportunity to grow the market and our share in it are significant.”

Structured products have exploded in complexity and variety over the past few years after taking a beating during the financial crisis. Regulators have cracked down, in some cases alleging that investments are being sold to clients who don’t understand the risks.

Bank of America’s Merrill Lynch unit in 2016 paid $10 million to the Securities and Exchange Commission to settle allegations that it misled investors on notes that later plummeted in value. UBS Group AG in 2015 paid $19.5 million in a similar case.

Bank of America and Morgan Stanley both sell structured notes, largely into their own wealth-management arms. Backing Luma could give them broader access to third-party distributors — if the new venture can ink deals with larger networks and win the loyalty of retail brokers.

Navian has historically sold to smaller distributors including Capital One Financial Corp. and MUFG Union Bank NA in California.

Write to Liz Hoffman at liz.hoffman@wsj.com